1099-INT: This lists the interest income you received from your bank from your checking, savings and other accounts, if applicable.1099-G: This form is your unemployment benefit statement.

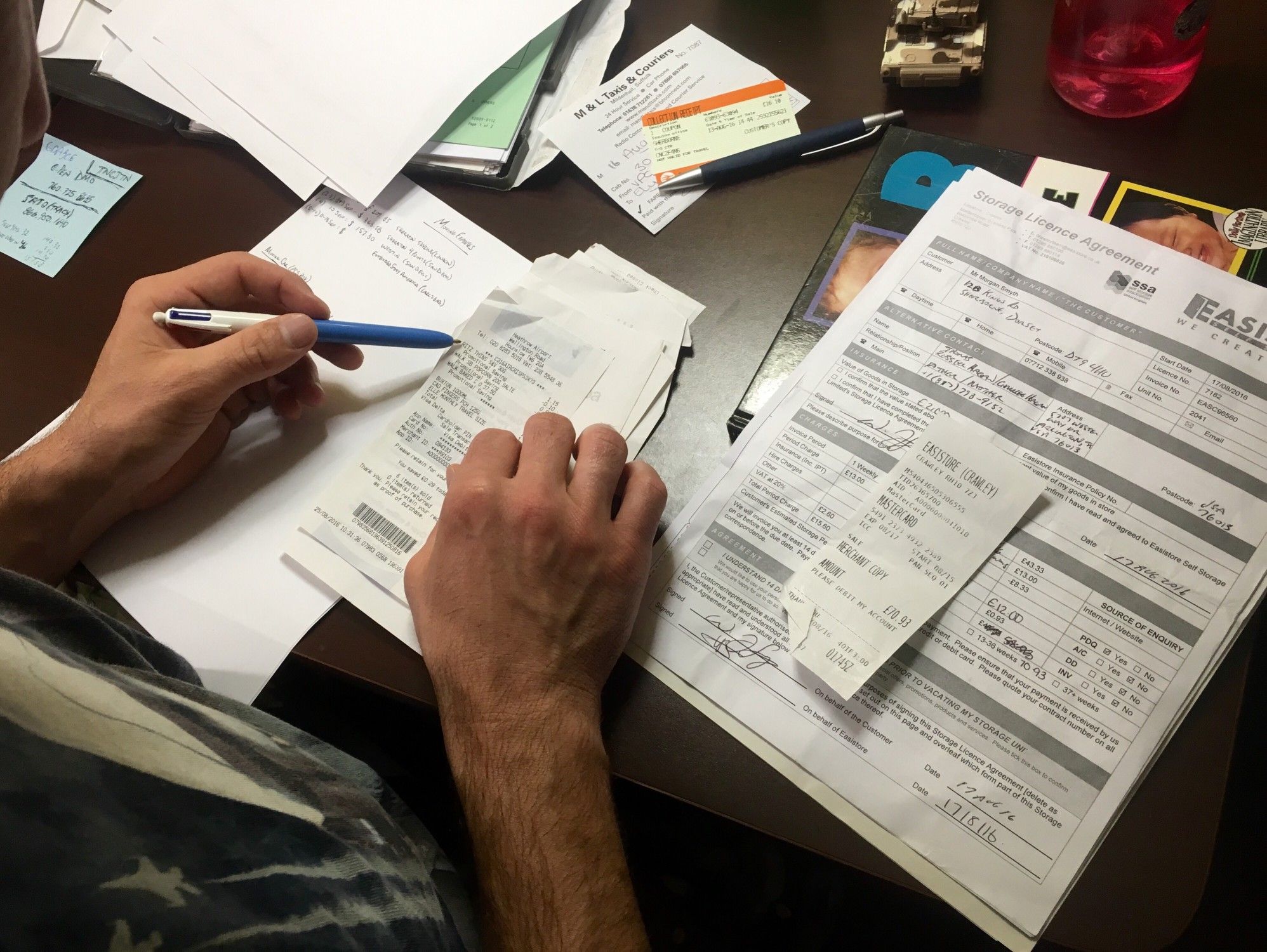

1099-DIV: This form reports your earnings from stocks and mutual funds, including dividends and capital gains distributions.1099-B: Your brokerage company will send you this statement of your investment account, as well as statements indicating when you bought and sold stocks, mutual funds or other securities.1099: If you're an independent contractor, you'll receive one of these forms showing your income from each of your clients.1098-E: This form details your student loan interest payments, if your interest is at least $600.1098: Your mortgage lender sends this form detailing your mortgage interest payments for the year (provided that you paid at least $600 in interest).W-2: This form from your employer shows how much money you made, tax and other deductions (including Social Security and Medicare) that your employer held from your paycheck, as well as your contributions to retirement plans, medical accounts and child care reimbursement plans.K-1: These forms report income from a small business, partnership or trust.These companies are legally obligated to put your statements in the mail by January 31 (or the following business day if it falls on a weekend).ĭepending on your situation, here are some of the forms you can expect to receive: You should have all your tax statements from your employer, bank, investment or brokerage firm and any other institutions that handle your money by early February. This approach will cost you a bit more time on the front end, but it could make all your paperwork easier to find and organize when you actually go to file your taxes. Divide the folder into categories like business expenses, charitable donations and office supplies to make everything easier to find later.Īnother option is to scan all of your paperwork and keep it in a file on your computer desktop. Have a clearly marked folder or box,into which you put all of your receipts, end-of-the-year bank statements and charitable donation forms as you get them. Avoid the dreaded April 14th scramble by keeping all of your tax information for the year in one place.

0 kommentar(er)

0 kommentar(er)